A recent report has found that whilst profits have increased for drinks manufacturers, many are still treading water amid an uncertain future.

The report found that drinks manufacturers generated £1.51 for every pound invested in inventory in Q4 2023 – up from £1.40 in Q3 2023.

This compared to an industry average of £2.33 across 16 manufacturing categories; drinks sector profitability was down on Q4 2022 when it stood at £1.56.

New analysis shows that UK drinks manufacturers are starting the year on a good footing after seeing their profitability improve over the ‘Golden’ Christmas Quarter.

Mid-sized firms in the sector have benefitted from demand for products and stabilising supply chains, according to the latest Manufacturers’ Health Index, compiled quarterly by inventory management software brand Unleashed.

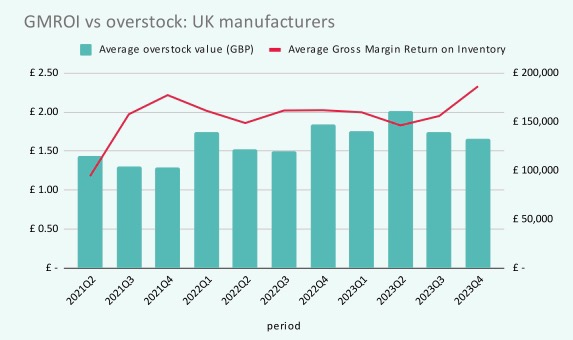

The report reveals data on GMROI (gross margin return on inventory) – a measure of the profits made on inventory costs – across 16 manufacturing categories. Manufacturers were also surveyed to gain first-hand insights into the specific challenges and opportunities they face.

Drinks manufacturers made an average of £1.51 for every pound invested in inventory, up from £1.40 the previous quarter. However, unlike most of the other manufacturing categories analysed, it was down on Q4 2022 when it achieved GMROI of £1.56.

Comprising both alcoholic and non-alcoholic drinks, the drinks industry is still ahead of food which is stuck on £1.44 – the same as the previous quarter and lower than Q4 2022 when it was £1.48.

Commenting on the findings Jarrod Adam, Head of Product, at Unleashed, said: “Drinks manufacturers held fast towards the end of 2023, with modest improvements in the final quarter.”

“Overall, the businesses we surveyed across different manufacturing categories were optimistic about 2024, with almost three-quarters saying they expect demand to grow this year.”

Brett Hirt, of Bristol Dry Gin, agreed with Jarrod: “The extension of the government’s Small Producer Relief in the last budget, to include more businesses than just brewers, means that our distillery has entered the ready-to-drink category, and can be competitive thanks to a lower duty burden.”

Overall, the report showed that the UK’s manufacturing sector has made a dramatic recovery – recording its best performance in more than two and a half years during the final quarter of 2023.

Firms made an average of £2.33 for every pound invested in inventory, up from £1.98 the previous quarter and £2.05 in the same period of 2022.

All but four of the manufacturing categories analysed saw an uplift in profitability during Q4, with clothing manufacturers and the energy chemicals sector storming ahead with £4.53 and £3.30 respectively.

At the other end of the scale, the most dramatic fall was in plastics and rubber, which saw its profits on inventory drop to £1.16 from £2.65. Health and medical manufacturers, and cosmetics and personal care were both down by 16p and 8p.

Summarising the findings, Jarrod Adam concluded: “The improvements in profitability show how well mid-sized manufacturers in the UK have rallied following the seemingly endless economic and supply chain uncertainty of the past few years.

“In navigating the supply chain and economic challenges they’ve faced, many firms have embraced technology to refine their inventory management processes, enabling them to achieve better margins on their inventory spend.”

For more information and for the full research, click HERE